"Quality of Life and Health Care Solutions"

Why Life Insurance Is Important!

Universal Life

There is no way to know what will happen tomorrow, but there is a way to protect your family against the unexpected loss of life. Our Universal life or 20-year term life coverage will meet those life changes today and tomorrow. Prudent financial planning can help you protect your families future and give you peace of mind.

Why People Have It!

As many as 132 million Americans rely on life insurance to protect their financial security. Major reasons given for owning life insurance include covering burial and other final expenses (51 percent), to help replace lost income (34 percent) and to help pay off the mortgage (26 percent).

More Coverage Needed!

However, 30 percent of Americans know they need more life insurance. That boils down to more than 70 million people. Twenty-five percent wish their spouse or partner would purchase some or more life insurance.

While 71 percent Americans say they research online, more than half want to work with a financial professional to purchase life insurance. About 1 in 4 consumers say they have bought or have tried to buy life insurance online, with younger consumers more likely to shop online than older people.

Half of the households in America would feel the financial impact from the loss of their primary wage earner in a year or less. In fact, over 40 percent would feel the impact within 6 months, including nearly 40 percent of households with an annual income of $100,000 or more.

Note – Facts from LIMRA, Life Insurance Awareness Month, September 2015

Accidents Happen

Accident Policy

Did you know that 29.5 million visits to the emergency room in a given year are accident related?

Every 10 minutes, more than 700 Americans suffer an injury that’s severe enough to seek medical help, according to the National Safety Council.

Accidents are a part of everyday life, are you prepared for the unexpected financial burden?

Accident coverage can help pay for some of those medical bills, out-of-pocket expenses or for any other purpose.

Designed to provide a financial cushion in the event of an accident.

Pays cash benefits you can use for medical bills and other out-of-pocket expenses, including your mortgage and other non-medical bills.

Accident insurance isn’t subject to health care reform legislation.

Accident Policy Benefits

Benefit Highlights

- Accident Emergency Treatment

- Follow-Up and Physical Therapy

- Initial Accident Hospitalization

- Accidental Death & Dismemberment

- Accident Hospital & ICU Confinement

Riders Included With Premium

- Expanded Benefits Rider

- Wellness Benefit

- Portable

Short-Term Disability

Coverage

Coverage

Coverage

- Did you know that 25% of those entering the workforce today will face disability at some point during their working lives? If you are one of them, you’ll probably get better and return to work after a recovery period, but how would you pay your bills in the meantime? Would you rather be focused on getting better, or worrying about your family’s finances?

Facts:

Coverage

Coverage

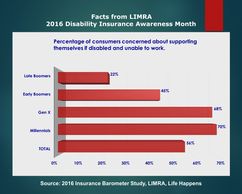

- Just over half of working Americans worry about the effects of a disability. Among younger workers the percentages are higher

Facts:

Coverage

Facts:

- The average worker faces a 3 in 10 chance of suffering a job loss lasting 90 days or more due to a disability.

- More than half of all personal bankruptcies and mortgage foreclosures are a consequence of disability.

Facts:

Facts:

Facts:

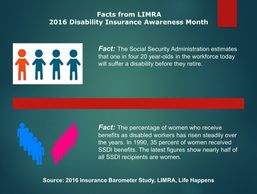

- The Social Security Administration estimates that one in four 20 year-olds in the workforce today will suffer a disability before they retire.

- The percentage of women who receive benefits as disabled workers has risen steadily over the years. In 1990, 35 percent of women received SSDI benefits. The latest figures show nearly half of all SSDI recipients are women.

Facts:

Facts:

Facts:

- 7 in 10 working Americans understand the importance of disability insurance, yet only one third have coverage

Facts:

Facts:

Facts:

- A study by Unum on 10-years of disability insurance claims reveals significant increases in musculoskeletal issues and joint disorders. Unum identified two specific trends driving the increases: aging baby boomers staying in the workforce longer and obesity, with more than a third of U.S. adults classified as overweight or obese.

Critical Illness Insurance

Critical Illness Coverage

When we hear the word insurance, most people tend to think of things like car or health insurance. Critical illness insurance is not one of the types of insurance that comes to mind.

Most people don’t want to think about the scarier health-related risks in life – especially critical illness. Unfortunately this inclination to turn away also often leaves us vulnerable and unprotected should we be diagnosed with a critical illness.

The reality is by the time we reach retirement one out of every four of us will be out of work due to illness or injury for longer than our accrued paid time off allows.

What Counts as a Critical Illness?

Illnesses can happen to any of us, at any time. It might be as simple as a cold or flu, or one of the several critical illnesses that affect Americans. The three major critical illnesses are:

- Cancer

- Heart Attack

- Stroke

Other critical illnesses can include:

- Blindness

- Multiple Sclerosis

- Organ transplants

- Kidney failure

- Paralysis

- Heart Valve Replacement

According to The American Association for Critical Illness Insurance, statistics show annually:

- Every 40 seconds someone in the U.S. has a stroke; 600,000 people will experience their first stroke.

- Every 34 seconds, an American will suffer a heart attack; 785,000 will have a new coronary attack.

- 1.5 million Americans will declare bankruptcy this year; 60% are due to medical bills (up 50% over six years).

This information originally appeared on the Council for Disability Awareness blog at: http://blog.disabilitycanhappen.org.

Critical Illness Benefits

Benefit Highlights

- Lump Sum Benefit

- Guarantee Issued $10,000

- Simplified Issued up to $50,000

- Category 1 – Heart Attack, Stroke, Heart Transplant

- Category 2 – Major Organ Transplant, etc.

- Category 3 – Cancer

Riders Included With Premium

- Reoccurrence Benefit

- Expanded Benefits Rider

- Wellness Benefit

- Portable

Cancer Insurance

Statistics at a Glance

Statistics at a Glance

Statistics at a Glance

- In 2016, an estimated 1,685,210 new cases of cancer will be diagnosed in the United States and 595,690 people will die from the disease.

- The most common cancers in 2016 are projected to be breast cancer, lung and bronchus cancer, prostate cancer, colon and rectum cancer, bladder cancer, melanoma of the skin, non-Hodgkin lymphoma, thyroid cancer, kidney and renal pelvis cancer, leukemia, endometrial cancer, and pancreatic cancer.

The Burden of Cancer

Statistics at a Glance

Statistics at a Glance

- The number of new cases of cancer (cancer incidence) is 454.8 per 100,000 men and women per year (based on 2008-2012 cases).

- The number of cancer deaths (cancer mortality) is 171.2 per 100,000 men and women per year (based on 2008-2012 deaths).

- Cancer mortality is higher among men than women (207.9 per 100,000 men and 145.4 per 100,000 women). It is highest in African American men (261.5 per 100,000) and lowest in Asian/Pacific Islander women (91.2 per 100,000). (Based on 2008-2012 deaths.

In the United States

Statistics at a Glance

In the United States

- The number of people living beyond a cancer diagnosis reached nearly 14.5 million in 2014 and is expected to rise to almost 19 million by 2024.

- Approximately 39.6 percent of men and women will be diagnosed with cancer at some point during their lifetimes (based on 2010-2012 data).

- In 2014, an estimated 15,780 children and adolescents ages 0 to 19 were diagnosed with cancer and 1,960 died of the disease.

- National expenditures for cancer care in the United States totaled nearly $125 billion in 2010 and could reach $156 billion in 2020.

Note – National Cancer Institute

Cancer Benefits

Cancer Benefits

In the United States

Schedule of Benefit Highlights

- Guaranteed Issue

- Hospital Benefits

- Surgery Benefits

- Radiation & Chemotherapy Benefits

- Wellness & Non-Medical Benefits

- Cancer Maintenance Therapy Benefit

- First Occurrence Rider

Cancer Benefits

Legal Shield Protection

Legal Shield Protection

Included Services

- Letters written on members behalf

- Phone calls made on members behalf

- Mobile app

- Live member support

- 24/7 emergency access

- Snap by Legal Shield

Auto Coverage

- Moving traffic violations

- Driver's license recovery

- Criminal charges and tragic accident coverage

- Property damage assistance

IRS and Tax Support

- IRS audit representation

- IRS collection defense

- IRS audit assistance

Trial Defense Services

- Civil lawsuits

Family Law

- Legal separation

- Divorce

- Adoption

- Name change

Real Estate Coverage

- Landlord tenant issues

- Residential loan document assistance

Estate Planning Coverage

- Wills

- Living wills

- Healthcare power of attorney

Member Discount

- 25% off standard hourly rate

Identity Theft Protection

Consultation

- Identity threats alert

- Unlimited consultations with license private investigator

- Emergency assistance 24/7

- Live member support

- Reduced pre-approved credit card offers/junk mail

- Credit inquiry alerts

- Lost wallet assistance

- Data breach notification

- Sex offender search

- Mobile app

- Social security number fraud detection

Identity Restoration

- Complete identity restoration

- Limited power of attorney

- Dedicated license private investigator

- $5 million service guarantee

Security Monitoring Services Include

- Credit report , social security , bank account number, credit/credit store card, name, date of birth, medical ID number, email address, phone number, drivers license, number, passport number, social media, payday loan and court records

- Monthly score tracker

- Black market website surveillance

- Minor identity protection

- Address change verification

- File sharing network services